Take your STABLE Account funds with you

Sign up today for a STABLE Visa® Card and access your funds from anywhere

Just load it up and go

Easy to control your spending

Instead of pulling money directly from your STABLE account, you load the card with exactly how much you’d like to spend.

Load up to $20,000

You can load as much or as little as you need, anytime, up to $20,000.

Spend anywhere Visa® is accepted

The STABLE Visa Card can be used everywhere Visa cards are accepted.

A card for everyone

Need an extra card? No problem.

If you’re an Authorized Legal Representative (ALR) for someone, you can order a card for yourself to make purchases for the beneficiary, a card for the beneficiary, or both. Each card has its own balance and spending controls, so you can decide how funds can be used.

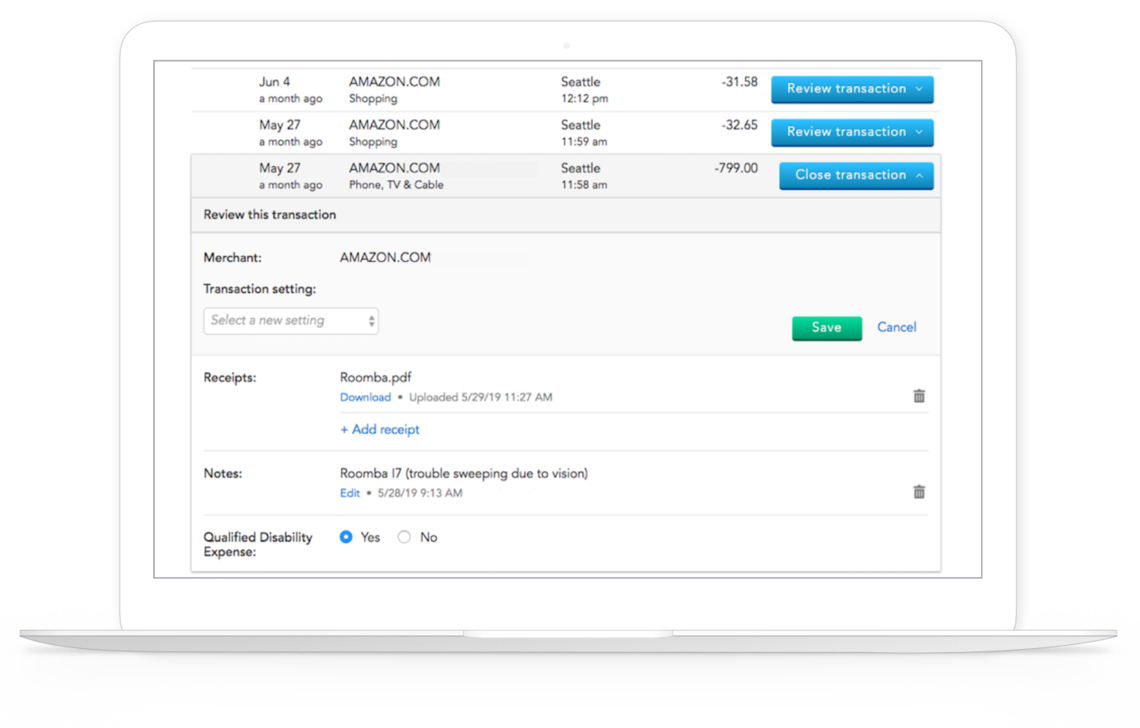

Easily record and track your expenses

See all transactions at a glance

Having a STABLE Visa Card makes it easy to track your STABLE account expenses. Once you get your card, you’ll be able to log into your Visa card account and see all of your Visa card spending over time.

Sort, filter, and categorize your expenses with ease

You can mark transactions as “Qualified” or “Non-Qualified” and even upload receipts or personal notes to make reporting things to the IRS, SSA, or Medicaid that much easier.

Keep your qualified expenses all in one place

Using a STABLE Visa Card allows you to clearly separate your STABLE account funds and qualified expenses from your other personal checking or savings account for easier reporting.

Help protect funds and enjoy peace of mind

Spending is limited to funds loaded on the STABLE Visa Card

If there are not enough funds on the STABLE Visa Card to cover a purchase, that transaction will simply be declined. There are no overdraft fees whatsoever.

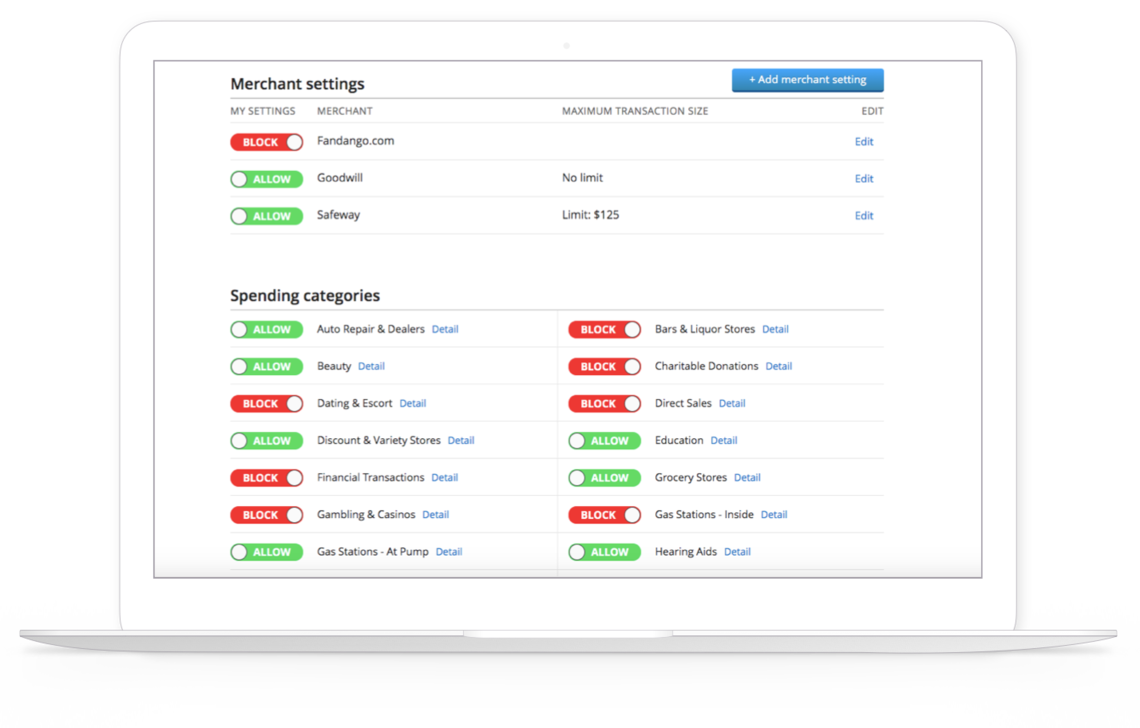

Built-in account protection

Once you receive your STABLE Visa Card, you can log in and set up customized restrictions on certain spending categories. You can also turn on SMS alerts for real-time notifications about activity on your STABLE Visa Card.*

FDIC insured

Visa card funds will be FDIC insured through Sunrise Banks, N.A., Member FDIC, provided the Visa card is registered in the name of the primary cardholder.

Not subject to benefits testing

Just like the funds in your STABLE account, the funds on your Visa card typically do not impact Medicaid or Supplemental Security Income (SSI) benefits eligibility.

*Standard text message rates, fees, and charges may apply.

Access your card with no monthly fee

There is no monthly fee with the STABLE Visa Card for Ohio residents and residents of Oklahoma, Utah, Vermont and West Virginia. All other states' residents will have a $5 monthly fee once the card is activated.†

†Other fees, terms, and conditions apply. See Cardholder Agreement.

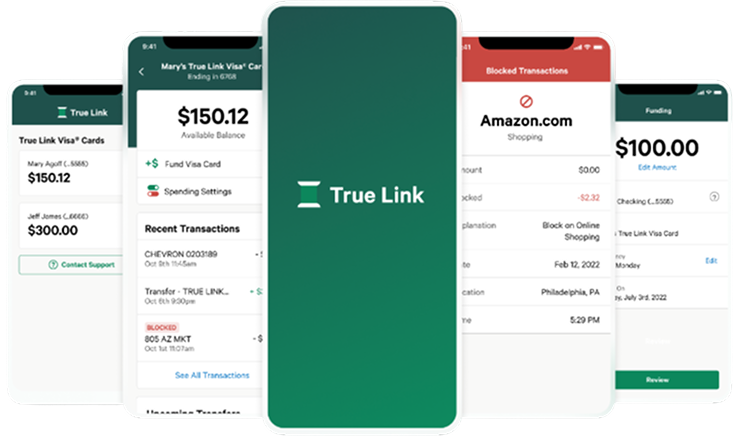

Manage your card anywhere

Easy access wherever you go

Download the True Link app to quickly and easily check your balance, review transactions, and manage spending settings — all from your phone.

Sign up today

Request your STABLE Visa Card and create an account

In just a few steps you can sign up to receive a STABLE Visa Card. After you’ve registered, it typically takes up to 6-8 business days to receive your first card in the mail. For any subsequent cards, you may opt to pay for expedited shipping, which takes 2-4 business days. Then, once your card is activated, simply load it with funds from your STABLE account and you’ll be on your way.

This card is issued by Sunrise Banks N.A., St. Paul, MN 55103, Member FDIC, pursuant to license from Visa U.S.A., Inc. This card can be used everywhere Visa debit cards are accepted. Use of this card constitutes acceptance of the terms and conditions stated in the Cardholder Agreement.

True Link Financial, Inc. is required to periodically report certain Card information to the Visa Prepaid Clearinghouse Services (PCS) to assist in fraud prevention. Please contact PCS Customer Service for details regarding the information reported and on file with PCS. PCS Customer Service Department’s business hours are Monday-Friday, 9:00 a.m.-5:00 p.m. Eastern Time.

Visa Prepaid Clearinghouse Services Customer Service Department

P.O. Box 4000

Conway, AR 72033

Phone: 1-844-263-2111 | Fax: 1-844-432-3609